Investing is a crucial component of long-term financial planning. It allows individuals to grow their wealth, secure their future, and achieve their financial goals. However, the investment landscape can be daunting, with a vast array of choices and complex terminology. This comprehensive guide aims to provide an understanding of the various types of investments, their characteristics, risks, and potential rewards.

Importance of Investing

Investing is essential for several reasons. It allows individuals to:

- Grow their wealth: By investing in different assets, individuals have the opportunity to increase their net worth over time.

- Secure their future: Investing helps individuals save for retirement or other long-term financial goals.

- Beat inflation: Inflation erodes the purchasing power of money over time. By investing, individuals have the potential to earn higher returns than the rate of inflation.

- Generate passive income: Some investments offer regular income, which can help supplement an individual’s primary source of income.

Overall, investing can help individuals build a strong financial foundation, protect against unforeseen expenses, and achieve their desired lifestyle.

Overview of Different Types of Investments

The investment world encompasses a wide range of options, catering to diverse risk appetites and financial goals. Let’s explore some of the major types of investments.

Stocks

Stocks are a type of equity investment that represents ownership in a company. When an individual buys stocks, they become shareholders and are entitled to a portion of the company’s earnings, known as dividends. The value of stocks can also increase over time, providing capital appreciation to investors.

There are two main types of stocks: common stocks and preferred stocks. Common stocks represent ownership in a company and offer voting rights and potential dividend payments. Preferred stocks, on the other hand, typically do not provide voting rights but offer fixed dividend payments.

Some key considerations when investing in stocks include the company’s financial health, management team, industry trends, and market conditions. It’s essential to conduct thorough research and diversify investments across different companies, industries, and geographies to mitigate risk.

Bonds

Bonds are a type of debt investment where an investor loans money to a borrower, typically a company or government entity. In exchange, the borrower promises to repay the loan with interest over a specified period. Bonds are generally considered lower-risk investments because they provide fixed income and have a predetermined maturity date.

There are different types of bonds, including government bonds, corporate bonds, municipal bonds, and high-yield bonds (also known as junk bonds). Each type has its unique characteristics and varying levels of risk and return.

Investors should consider factors such as credit rating, interest rate, and maturity when investing in bonds. Higher-rated bonds usually offer lower interest rates but are less risky than lower-rated bonds, which carry higher interest rates to compensate for their increased risk.

Mutual Funds

Mutual funds pool money from multiple investors to invest in various securities such as stocks, bonds, and other assets. They offer a ready-made portfolio managed by professional fund managers, making them a popular choice for novice investors.

There are different types of mutual funds, including index funds, actively managed funds, sector-specific funds, and target-date funds. Each type has its investment objectives, risks, and costs.

One of the key benefits of mutual funds is instant diversification. By investing in a mutual fund, individuals gain exposure to a variety of assets, reducing the impact of a single investment’s performance on their overall portfolio.

Real Estate

Real estate is a tangible asset that includes properties, land, and buildings. Investing in real estate can generate income through rental properties and capital appreciation when the property’s value increases over time.

There are different ways to invest in real estate, such as direct ownership of properties, real estate investment trusts (REITs), and real estate crowdfunding. Each type of investment has its pros and cons, and investors should consider factors such as cash flow, location, and market conditions when making real estate investments.

Real estate can offer a hedge against inflation and diversify an investment portfolio. However, it also requires significant capital and carries risks such as vacancies, maintenance costs, and market fluctuations.

Commodities

Commodities are physical goods that can be bought and sold, such as gold, oil, or agricultural products. Investing in commodities can provide diversification and a hedge against inflation, as their prices tend to rise during times of economic uncertainty.

There are different ways to invest in commodities, including buying physical commodities, investing in commodity futures contracts, or purchasing shares of companies involved in the production or distribution of commodities. Each option carries its own set of risks and potential rewards.

Investors should carefully research the supply and demand dynamics, geopolitical factors, and global economic conditions when considering investing in commodities.

Cryptocurrency

Cryptocurrencies, such as Bitcoin and Ethereum, have gained popularity in recent years as a digital form of currency. They operate independently of central banks and are based on blockchain technology.

Investing in cryptocurrencies is highly speculative and carries high risks due to their extreme volatility. However, it can also offer potentially high returns for those who are willing to take on the risk. It’s crucial to thoroughly research the fundamentals, market trends, and risks associated with each cryptocurrency before investing.

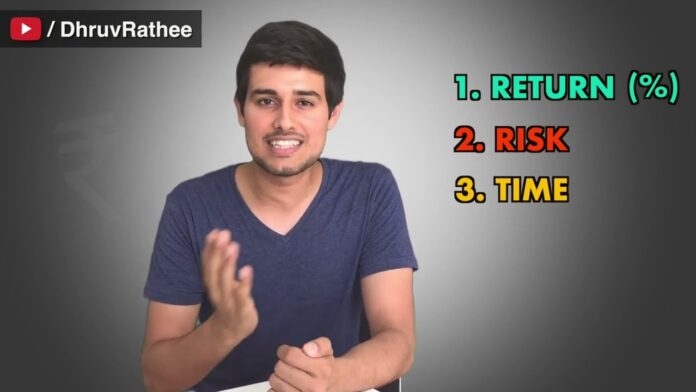

Risk and Return Considerations

One of the key principles of investing is the relationship between risk and return. Generally, higher-risk investments offer the potential for greater returns, while lower-risk investments provide more stable, but often lower, returns.

To make informed investment decisions, individuals should consider their risk tolerance level, time horizon, and financial goals. For example, a young investor with a long-term horizon may be able to withstand higher levels of risk and focus on growth-oriented investments, while a retiree may opt for more conservative investments to preserve their wealth.

It’s also essential to understand the different types of risks associated with each investment. Some common risks include market risk, credit risk, inflation risk, and liquidity risk. A diversified portfolio can help mitigate these risks by spreading investments across different asset classes and industries.

Diversification

Diversification is a crucial concept in investing. By spreading investments across various assets, individuals can reduce their overall risk exposure. For example, if one investment performs poorly, gains from other investments can offset the losses.

In addition to asset diversification, individuals should also consider geographic diversification. Investing in different countries can help mitigate the impact of local economic and political factors on an investment portfolio.

However, it’s essential to note that diversification does not guarantee profits or protect against losses. It’s vital to regularly review and rebalance a portfolio to ensure that it aligns with an individual’s risk tolerance and financial objectives.

Conclusion

Investing is an essential part of long-term financial planning. By understanding the different types of investments and their characteristics, individuals can make informed decisions and build a diversified portfolio that aligns with their risk appetite and financial goals. Remember to conduct thorough research, consult with a financial advisor, and regularly review and adjust your investment portfolio to stay on track towards achieving your financial objectives.